Mankato's Trusted Family Insurance Agency

We’re the independent insurance agency that treats you like family, not just another policy number. With deep roots in Southern Minnesota communities, we provide personalized coverage solutions backed by hometown values and exceptional service.

Why Local Families and Businesses Trust Rehm Insurance

We believe that protecting what matters most to you shouldn’t be complicated. As an independent agency, we partner with the nation’s top carriers to find the perfect coverage for your needs.

You have enough on your plate without having to compare complex insurance policies on your own. Our team at Rehm Insurance takes the time to understand your specific needs, whether you’re buying your first home or teaching your teenager to drive!

We’ll explain your coverage options in clear, simple terms and help you find the best rates through our network of top insurance carriers.

As local agents, we also know the special challenges of living and working in Minnesota, from icy winters that take a toll on your car to summer storms that wreck havoc on your house.

When you work with us, you’re not just getting an insurance policy – you’re gaining a dedicated partner who’ll be there when you need us most, from routine policy questions to compassionate crisis response.

Our services

At Rehm Insurance, we’re proud to be your local, independent insurance agency serving families and businesses throughout the Mankato area and beyond.

For years, we’ve helped our neighbors find the right coverage for their homes, vehicles, businesses, and loved ones by partnering with the nation’s top insurance carriers to provide personalized solutions.

Whether you need auto, home, life, or business liability insurance, we’re here to provide the personal attention and expert guidance you deserve, right around the corner when you need us most!

Home Insurance

Protect your piece of Minnesota paradise with coverage that safeguards your home & what makes it special. Find out more..

Auto Insurance

Your family can drive with confidence, knowing you have the right protection for whatever comes your way. Find out more..

Life Insurance

Give your loved ones the security they deserve with personalized coverage that protects their future. Find out more..

Commercial Insurance

Focus on growing your business while we protect everything you've built. Find out more..

On our blog

2026 Home Insurance Predictions

While I don’t have a crystal ball, I can tell you my professional opinion on the coming year’s home insurance industry. After years of being in the business, I have my finger on the pulse of upcoming changes. I keep an eye on things at all times to ensure my

What Happens If You’re Underinsured?

Are you investing in the bare minimum insurance? You may think that saving on monthly premiums is helping your bottom line, but being underinsured can be much more financially devastating than having no insurance at all. Let’s talk about what happens if you’re underinsured, how to tell if you need

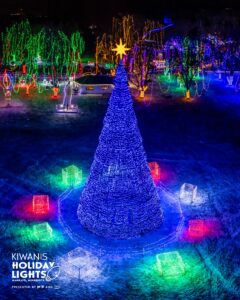

2025 Holiday Lights Displays In and Around Mankato, MN

Some of the most magical memories of every holiday season are the quality family times! There are only a few times of year when we can all gather and truly enjoy one another. If you are looking for some family fun this holiday season, why not take in the sights

Insurance Changes After Divorce: A Guide to Protecting Your New Future

Life is full of changes, and if you are experiencing a divorce, chances are you have a lot of details to work out. While we know there is a LOT to consider while going through a marital separation, it’s important to keep an eye on your insurance policies, too. Let’s

Contact Our Team today

Experience the difference of working with a local, independent insurance agency that puts your needs first.