It seems they are everywhere you look. Weird emails hitting your personal and work inboxes. Annoying text messages with fake warnings. Random phone calls, and even shady people on social media — scams are everywhere!

The best protection we can have for such scammers is simply diligence. By educating yourself, educating your loved ones (especially young people and the elderly), and staying alert, you can avoid most cyber criminals seeking to take advantage of kind souls willing to provide personal data.

How Many People Get Scammed?

Did you know that one in three Americans have been scammed in the past year? As scams become more sophisticated, it can be difficult to know where to draw the line. We’ll be going over some tips that can help you differentiate fact from fiction – but first, let’s dig into what scams look like.

While the stereotypical Nigerian prince needing help depositing his funds into an American bank account is an obvious scam, today’s scammers are much more stealthy. Perhaps we should thank the “Nigerian prince” for alerting more people of such cons, since many of us have our radar up!

But sadly, con artists seem to have no shortage of ideas to scam innocent people. Every time we think we’ve kept up with the latest tactics, and blocked their numbers and email addresses, new schemes keep popping up.

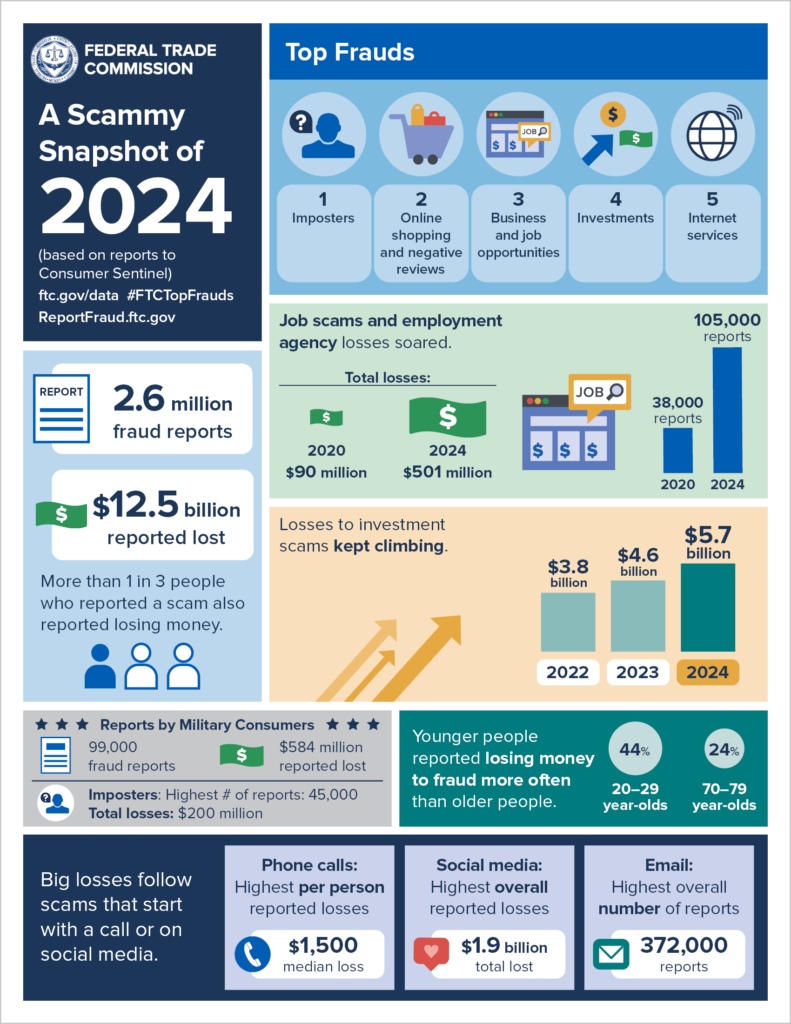

Why? Because they work. The Federal Trade Commission recently reported that consumers lost over $12.5 billion to fraud in 2024, which represents a 25% increase over 2023. Check out this staggering summary report:

What Are the Tell-Tale Signs of Scams?

If you get a message (email, text, phone call, mailing, etc.) there are a few signals that might help you determine if something is spam. Firstly, do not ever give out your personal information. There is no reason your bank, for example, would need your account number from you if they called you. They have that on file, and would not reach out to you for a PIN or number.

Secondly, check the source. Hang up the phone, take the name of the alleged contact, and search for that person’s office information online. Let’s say you’re contacted by someone claiming to be your phone company. Google your phone company online – and make sure you find the official website, not the AI summary. Find its toll-free number and call them. Ask them if they are, in fact, trying to reach you. If the call is legitimate, they’d have no problem with you confirming that with a main office.

If you are dealing with an email or text, check the sender. If the number is not listed, not a public-facing company number, chances are that it is not the true organization. Remember scammers can easily steal a logo, copy a social media page, or even spoof a phone number to trick you. The true test is to hang up (or ignore the message) and confirm by reaching out to your provider.

Also… do not click links!! If you get an email or text message with a link, and you were not expecting that to be sent to you or it looks weird or “off,” do not click the link. Worst case, you’ve now had your personal information stolen through malware, and best case, the scammer knows the link was clicked, and they will retarget you now, since they now know you’re a real person at the other end of that phone number or email address.

Scams are often based on the premise that you have to pay a penalty. The sender will tell you that you have to pay them in a way that might be unusual for you, such as cryptocurrency, wiring money, using a payment app, or through a gift card. Legit organizations will not insist on immediate payment in these unusual ways.

Another sign of a scam is when the scammer creates fear and urgency. The FTC puts it best: “Resist the pressure to act immediately. Honest businesses will give you time to make a decision. Anyone who pressures you to pay or give them your personal information is a scammer.”

Scams in the Insurance Industry

People sometimes fall for scammers that pretend to be from their insurance companies! I recently had a client contact me, and I’m very thankful he did. He’d gotten a text that said we were reaching out. The text said something like, “This is your insurance agent. You can get a refund on your premium by clicking the link below.”

Confused and alarmed, this client of mine did the right thing. He called me. As his insurance agent, I would never send such a vague and cryptic text. In fact, the only text I would send would immediately identify myself as Rehm Insurance, and I would not communicate with you in such a cryptic way.

Keeping My Clients Safe

At the end of the day, the best way you can catch scams is to be cautious, use your head, and refuse to divulge information. Worst case, you will have to return the call of authentic providers. That would be eons better than accidentally allowing access to your personal information or finances to a scammer.

If you are ever contacted by someone claiming to be your insurance agent and they are showing signs of being a scammer, simply hang up (or ignore), and call my office directly: (507) 345-3366.